Commercial awareness for every student

Students don't just memorise. They do. And when they do, they understand.

Building workplace confidence through realistic business simulations and practical tools. For business teachers, careers leads, and whole-school enrichment.

Three ways to build commercial awareness

Choose your delivery model

One-off facilitated events or year-round platform access. Many schools use both.

Business Simulation Days

We come to you and run it. Fully facilitated.

Students run virtual businesses in teams, making real decisions about pricing, staffing, marketing, and operations. They compete, see consequences in real-time, and develop genuine commercial understanding.

- Fully facilitated on your site

- 73% better comprehension than traditional methods

- Works for business students AND whole year groups

- Supports Gatsby Benchmarks 5 & 6

Best for: Enrichment days, careers events, inter-school competitions

"The students were buzzing." — The Grocers' CharityExplore Business Simulations

Skills Hub Education

Every student gets a Workplace Readiness Score.

Zero-prep 45-minute sessions for whole-school careers provision. Your dashboard flags students who need support. They leave with evidence portfolios ready for UCAS and job applications.

- Workplace Readiness Score (0-100, 8 competencies)

- Automatic intervention alerts for teachers

- Meets Gatsby Benchmarks 3 & 4, supports 5 & 6

- Exportable portfolios for applications

- UCAS Application Support: evidence sentences for personal statements, reference compilation for coordinators

Best for: Careers leads, PSHE coordinators, tutor time delivery

Explore Skills Hub EducationSkills Hub Workforce

Organisational skills development and workforce readiness.

Scalable skills training platform for organisations. Track workforce competencies, deploy targeted learning modules, and measure development across teams. Built for corporate L&D and talent development.

- 8 exam boards, 28 specifications, 1,456 lessons mapped

- Zero to 5 minutes setup time

- Saves 120 hours per year

- 91% teacher adoption rate

Best for: L&D teams, HR departments, training managers

Explore Skills Hub WorkforceNot sure which you need? Many schools combine a simulation day with ongoing platform access. Talk to us about your goals.

Discuss Your NeedsInside Skills Hub Education

Measurable skill development. Not just participation.

Every student builds a profile showing exactly which competencies they're developing, how much they've grown, and which tools contributed. Evidence for UCAS. Evidence for Ofsted. Evidence that means something.

Competency Trends

Track how your 8 competencies have developed over time

competencies tracked individually

progress visualisation

evidence portfolios

Trusted by leading schools and livery companies

"I hear and I forget. I see and I remember. I do and I understand."

— Confucius

Building workplace confidence through doing. Not watching. Doing.

3.5 million UK teenagers need workplace readiness. Only 527,000 study business. Commercial awareness shouldn't be limited to business students.

Our simulations and tools put students in the driver's seat. They make decisions, see consequences, and develop genuine understanding. Whether it's a facilitated simulation day or a 15-minute classroom activity, the principle is the same: active learning beats passive consumption.

Active learning improves retention by 9% and reduces failure rates by half a grade compared to traditional methods (Freeman et al., 2014).

This isn't business education. It's workplace preparation for everyone.

See the researchHow it works

We Plan It Together

Choose your date, year group, and format. We handle logistics, materials, and facilitation. You just need a venue and students.

Students Compete

Teams run virtual businesses for a simulated year. They make decisions on pricing, marketing, staffing, and operations. Real consequences. Real competition.

Everyone Wins

Students gain workplace confidence and commercial understanding. Teachers get engaged learners. Schools get Gatsby evidence. You get a memorable enrichment day.

Deploy Zero-Prep Sessions

45-minute activities ready to go. No business expertise needed. Works in tutor time, PSHE, or dedicated careers lessons.

Track Workplace Readiness

Every student gets a score (0-100) across 8 competencies. Your dashboard flags students needing intervention. Gatsby evidence generates automatically.

Export Evidence Portfolios

Students get portfolios for UCAS and job applications. You get Ofsted-ready reports. Time saved: 40+ hours annually.

Deploy Targeted Modules

Choose from competency-mapped learning modules. Align training to organisational objectives and role requirements.

Track Team Progress

Real-time dashboards show competency scores across teams. Identify skill gaps and measure training ROI.

Scale Workforce Development

Enterprise-ready platform that grows with your organisation. Data-driven skills development at scale.

What educators say

"The business simulation delivers powerfully realistic and engaging scenarios. It serves as a personal development tool for building essential skills in any student. We will be looking to extend this across our Harris Sixth Forms."

Harris Sixth Forms

"I just wanted to say a big thank you on behalf of the Grocers and our schools. The students were buzzing. They told me they would never have thought they would have access to something like this. They learnt so much."

The Grocers' Charity, Education

"I really enjoyed the business simulation - it was invaluable in teaching me the necessary skills for real-world success. The fun of the business sim was so good we were actually engaged."

The Haberdashers' Schools

Already using Springpod?

Good. Keep using it. Springpod helps students discover what careers exist. Skills Hub helps them build the skills those careers require. Different tools, different purposes. Use both.

| Feature | Springpod | Skills Hub |

|---|---|---|

| Focus | Career exploration | Skill development |

| Output | "Explored 10 careers" | "Scored 78/100 on commercial awareness" |

| Gatsby | BM5 (employer encounters) | BM3 & BM4 (tracking & curriculum) |

Meet the team

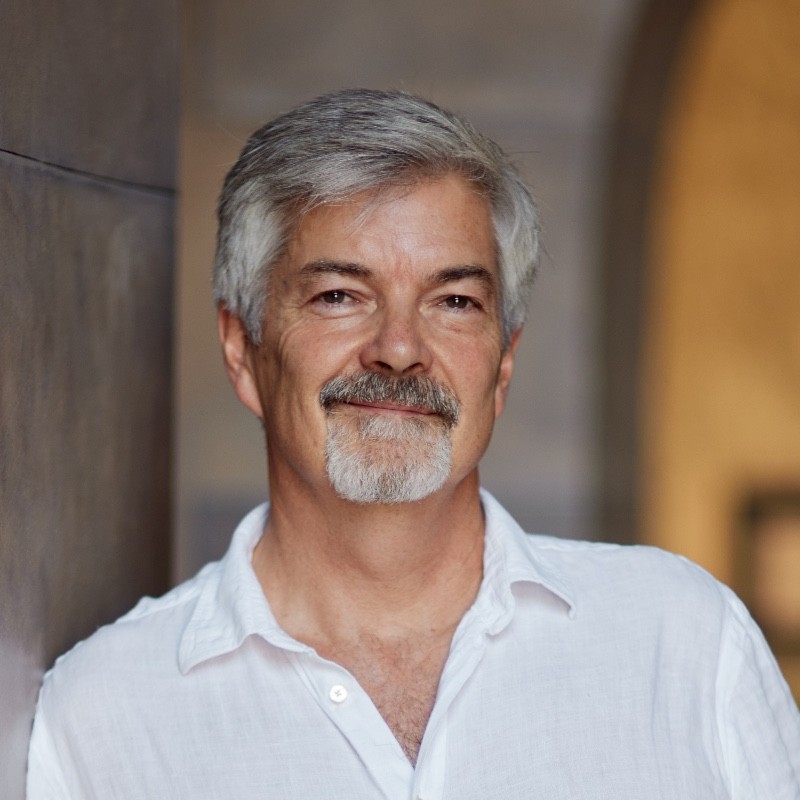

Elliott Giles

Founding Advisor

Business and Economics Lead at Harris Federation with deep insight into secondary education curriculum needs

Ready to build workplace confidence?

Join 50+ schools using Enterprise Skills for simulation days, curriculum delivery, and careers provision.